7. Rate rises & the cost of debt to the Australian tax payer

The burden of interest on government debt

There is no question that we are being conditioned psychologically to brace for more rate increases from television sets, radio, alternate news, and all the ‘experts’. Remember to look at market figures like the long term interest rates when absorbing this information.

Canstar, another of the large award-winning financial comparison sites, released on the 28/02/2023 that we can expected at least another 2 straight hikes in March and April, and interests rate would remain at the higher level until as far away as the end of 2024.

https://www.canstar.com.au/home-loans/when-will-interest-rates-go-down/

But, since nothing happened in March 2023, it looks like all of the big bank economists were wrong again. Why is it, that the experts get it wrong so often?

The recent banking failures in the USA including one of the 20 largest, Silicon Valley Bank (SVB) along with other smaller banks, should be enough to have government officials and international bankers reverse course on pushing the cost of debt any higher, the people of Australia are already in uncharted waters, past the point of pain they have ever endured before.

But the big-ticket item to understand amongst all the noise with these increases, is the impact on the debt load of Australia. Current Australian Debt across federal, state and local Government estimates range between $1,682,000,000,000 (1.682 Trillion)

https://australiandebtclock.com.au/

and $1,023,000,000,000 (1.023 Trillion) https://www.taxpayers.org.au/debt-clock. Let’s stay conservative on the low end with a $1.1 Trillion estimate. With a cash rate of 3.60% the cost to the Australian tax payer is now $39,600,000,000 (39.6 Billion) annually. If you will recall from earlier, there are 14 million of us working and taxed on our sweat equity. To put it in perspective that is $2,829 of tax for each of the 14 million working people required to pay just the interest owed on our national debts. Where does this money go?

$2,829 of the income tax means that the first $34,000 of earnings for every working person in 2023 (

https://paycalculator.com.au/

) is required just to pay the interest on our government debt. Who are we borrowing this money from, where do our hard-earned wages and salaries, collected as tax end up?

Working population recap.

Around 14 million are working.

9.6 million at minimum wage or below. This is 39% of the total population, or 50% of the working age population.

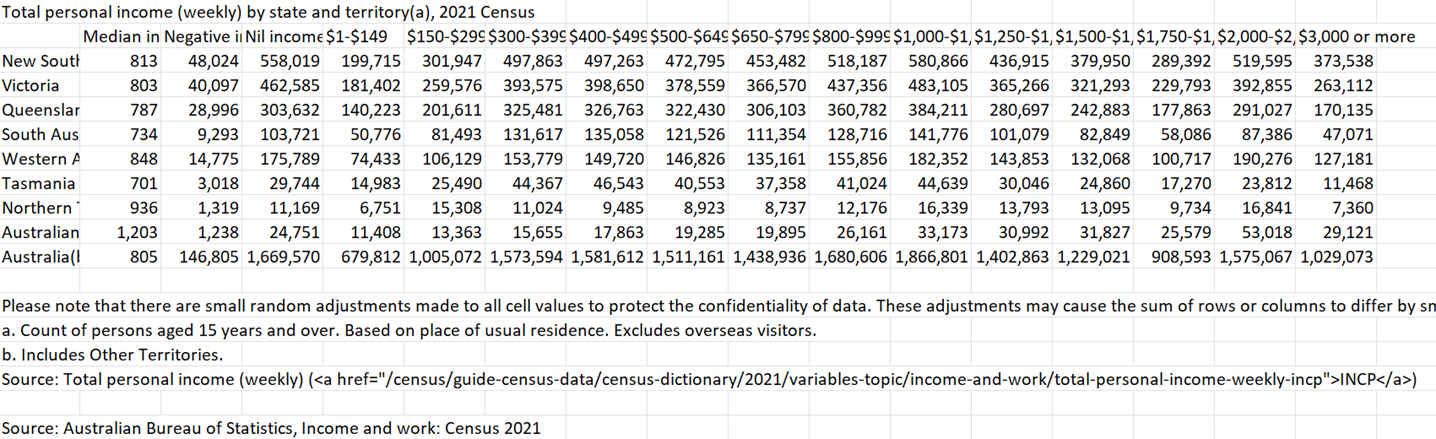

When taking the income data from the 2021 census. We can average the income from each section. And estimate the average income tax paid.

Example

Income $400-$499

Average annual $23,400

Ave Income tax $288

People 1,581,612

Total tax revenue $455,504,256

When you complete this exercise to the point where we can cover off $39.6 billion. It takes 100% of the individual income tax contribution of over 13.5 million of Australia’s 15y.o+ population to pay just the interest at the RBA, who lend the money, with interest, to we the people. That is all the income tax for all Australian’s earning $0 up to slightly more than $68,000. Let that sink in, but also ask yourself, where does this money go?

There is no accurate recording of dollar size Government debt in 1990. All sources show different numbers and adjustments for inflation for debt and GDP.

Macrotrends has data in 1990 for $311 billion USD for GDP and debt at 12.23% of GDP, so $38 billion USD.

In any circumstance, the wage growth at the time was in line with inflation, that is not the case today. But the significant data point to view and keep in mind is the reaction of governments in times on inflation and slow growth. In the past we have not increased spending and not increased government debt. In the lead up to 1990 and to 2008 we reduced our debts. So why are they increasing it, now for 15 years straight this time, in the lead up to today’s crisis and not pulling back?