Offset vs Redraw - It isn't complicated

Key points to understand before deciding what is right for your situation

Understanding the Difference Between Offset Accounts and Redraw Facilities

When managing a mortgage, many borrowers aim to reduce their interest payments and accelerate loan repayment. Two popular features designed to help achieve these goals are offset accounts and redraw facilities. Though both serve similar purposes, they function differently. Let’s explore how each works:

Offset Accounts

An offset account is a transaction account linked to your home loan. The balance in this account is offset against the amount you owe on your mortgage, reducing the interest charged. Placing $1 in a 100% offset account cancels out the interest charged on $1 of your home loan.

How It Works:

If you have a mortgage of $300,000 and savings of $20,000 in your offset account, interest will be calculated monthly on only $280,000. Your monthly repayment remains unchanged.

The higher the balance in your offset account, the less interest you'll pay, allowing a greater portion of your repayment to go toward reducing the principal, which helps accelerate the repayment of your loan.

The offset account functions like a regular transaction account, allowing deposits and withdrawals as needed. Interest is calculated daily

Benefits:

Interest Savings: By reducing the principal on which interest is calculated, you can save significantly over the life of your loan.

Flexibility: Funds in the offset account are easily accessible for everyday transactions.

Tax Efficiency: Interest savings from an offset account are not considered taxable income.

Considerations:

Some lenders may charge higher fees for loans with offset accounts, typically ranging from $300 to $400 annually.

Offset accounts are most beneficial for borrowers who can maintain a significant balance in the offset account and have larger loans.

Example:

Loan Amount: $300,000

Offset Account Balance: $20,000

Net Balance: $300,000 - $20,000 = $280,000

Interest is calculated on $280,000 instead of the full $300,000 loan amount, reducing the interest you pay and enabling more of your repayment to reduce the loan principal.

Interest Calculation:

Interest Rate: 6% per annum

Daily Interest Rate: 6% / 365 = 0.016438%

With the offset account:

Daily interest: $280,000 x 0.016438% = $46.03

Without the offset account:

Daily interest: $300,000 x 0.016438% = $49.32

This results in a daily interest reduction of $3.29, or about $1,200 annually.

Redraw Facilities

A redraw facility allows you to make extra repayments on your mortgage and access those additional funds if needed.

How It Works:

As an example, if your minimum repayment is $1,500 but you pay $2,000, the extra $500 can be redrawn at a later date, if necessary. These extra repayments reduce your principal balance, lowering the interest charged, which in turn accelerates your repayment timeline.

Benefits:

Interest Savings: Extra repayments reduce the principal and, as a result, the interest you pay.

Access to Funds: You can withdraw the extra repayments if you need access to the funds - pending your banks policy.

Flexibility: It offers a way to manage unexpected expenses without needing separate savings.

Considerations:

There may be limits on how often and how much you can redraw.

Some lenders charge fees for using the redraw facility.

Lenders can suspend access to redraw amounts at any time based on their lending policies.

It may not be as convenient as an offset account for regular transactions. Need to log in and transfer when you need access to funds.

Example:

Loan Amount: $300,000

Extra Repayments Made: $20,000

Remaining Balance: $300,000 - $20,000 = $280,000

Interest is calculated on the $280,000 remaining balance. If you redraw some of the extra repayments, the balance on which interest is calculated will increase accordingly.

Interest Calculation:

Interest Rate: 6% per annum

Daily Interest Rate: 6% / 365 = 0.016438%

With extra repayments:

Daily interest: $280,000 x 0.016438% = $46.03

Without extra repayments:

Daily interest: $300,000 x 0.016438% = $49.32

This results in the same $1,200 annual reduction as with the offset account.

Repayments and Loan Balance

Offset Account:

If you have money in your offset account, your contracted repayments remain the same, but a larger portion goes towards the principal because the interest charged is lower due to the offset account balance.

Without an offset balance, for a $300,000 loan over 30 years at 6%, your contracted monthly repayment is $1,798.65. In the first month the interest portion (calculated daily) begins at $1,500.00. So for the first repayment $298.65 goes towards reducing the principal.

With an offset balance of $20,000, the interest charged in the first month would be $1,400.00. So you would have a $398.65 reduction of the loan principal for the month, which creates compounding benefits each repayment period.

Redraw Facility:

Extra repayments reduce the principal directly, thus lowering the interest charged in subsequent periods.

If your monthly repayment is $1,798.65, and you have made extra repayments of $20,000 against your loan, sitting in your redraw, the principal is reduced faster.

If the interest portion of the repayment for the 1st month is then reduced to $1,400.00 with redraw rather than $1,500.00 without ($1,798.65 regular repayment - $1,400 interest) $398.65 goes towards reducing the principal for the first month.

This then also creates compounding benefits each repayment period.

In both cases, the goal is to pay off the loan faster by reducing the principal, thus saving on interest and shortening the loan term. The difference lies in the control over the funds and flexibility in accessing them.

What information do you likely not know?

Where is your money the safest?

Offset Account:

An offset account is a transactional account that is your asset, that you pay the bank to hold for you.

The Financial Claims Scheme (FCS) is an Australian Government scheme that provides protection to deposit-holders banking with authorised deposit-taking institutions or ADIs. The FCS is a government-backed safety net for deposits of up to $250,000 per account holder per ADI. So in your transactional offset account, $250,000 is covered by the scheme.

Amounts over $250,000 are subject to the same risks as any investment.

Redraw Facility:

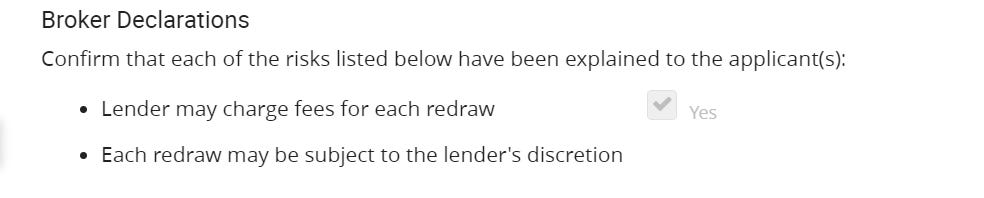

A redraw balance is a portion of money paid in front of the scheduled loan repayments, it is paid into the loan, it is the banks asset, it is ‘their’ loan account, and if it has been paid in advance it is not guaranteed to be returned. Many lenders make sure that the borrower is formally aware of this in the application process.

Here is a live example from one of the big 4 banks; it is up to the bank to release.

In the last decade or so, and always in hard times, there are numerous occasions that prominent ADI’s, without warning, have restricted or removed access to customers redraw. It is ‘their’ asset.

Some examples that I remember are:

Bank of Queensland (BOQ) (2021)

ANZ (Australia and New Zealand Banking Group) (2020)

NAB (National Australia Bank) (2020)

ME Bank (2020)

Westpac (2019)

Suncorp Bank (2015)

St. George Bank (2014)

ING Direct (2013)

Although you aren’t at risk of loosing the funds, like in an investment, you are at risk of losing access to them in hard times.

Which One is Right for You?

Choosing between an offset account and a redraw facility depends on your financial goals and personal situation. Here’s a breakdown to help you decide which is best for you:

Offset Account: Best suited for those who can maintain a high balance and want easy access to their funds. It’s ideal for individuals or families who manage their spending through a single transaction account. Funds in an offset account (if with an ADI) are protected up to $250,000. This option is great for those with limited time to monitor their finances and who are willing to pay an annual fee (typically $300-$400) to have their entire balance work for them without constant oversight.

Redraw Facility: Suitable for borrowers who want to make extra repayments and have access to those funds for emergencies or large expenses.

This option works best for those who have the time and discipline to budget and save money. However, access to these funds is not guaranteed.

Both options offer valuable benefits and can help reduce the total interest paid over the life of the loan. It's important to review the terms and conditions of your loan and consult with an expert to determine the best strategy for your needs and goals.